October 16, 2024 · Blog Posts

Pricing Up Option Spreads with Rival One Functionality

The difference between futures and equities trading tools vs. options trading tools can be quite jarring. With futures and equities, it is common practice to view a simple order book along with a chart that has a few studies on it, or even use a static ladder. On the other hand, options workstations are completely different.

Instead of looking at one market and a few time-tested indicators, you are confronted with dozens of strikes, puts and calls, various spreads, and even Greek symbols.

Rival One Options functionality, helps make sense of these elements and allows you to navigate all the details to make informed trading choices.

One of the most valuable functionalities of the Rival One platform is the ability to quickly price up spreads.

Pricing Up Spreads

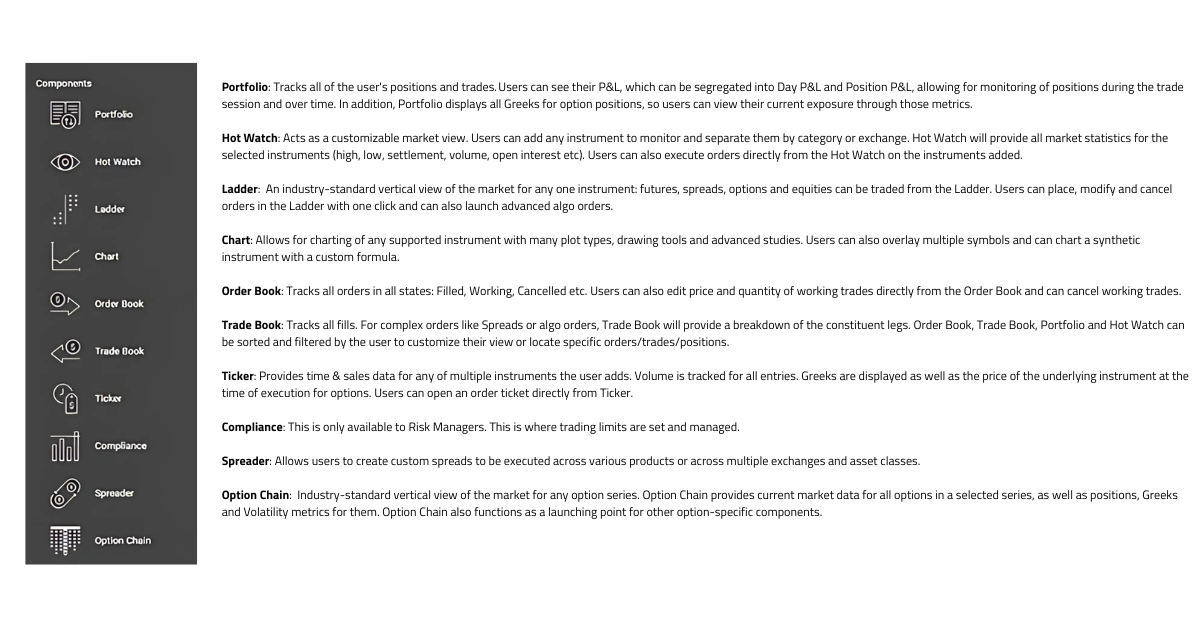

The first step to viewing the options market is to add the Options Chain component to a workspace, enter the base symbol, and select the option symbols. The system will automatically load all of the listed options with the associated theoretical prices, implied vols, greeks, and market data.

From the Option Chain there are two ways of pricing up spreads

- Click on the specific strikes to see all possible spread combinations.

- Left click or right click on the theoretical price to buy or sell specific options.

Pricing Spreads by Strike

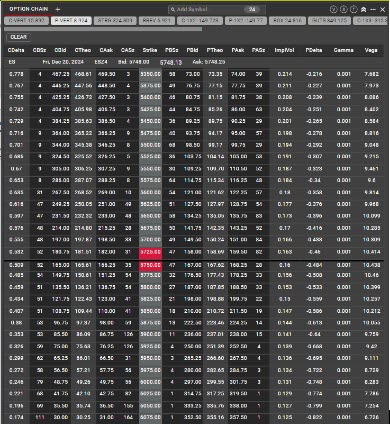

When a user clicks on a strike, the platform will automatically show the theoretical value call, put, the straddle, and the combo. If the user clicks on two strikes, the platform will pull up all of the possible spreads that can be created from those two strikes: call verticals, put verticals, strangles, risk reversals, box spreads, etc.

If the user clicks on three strikes, the platform will pull up butterflies, call trees, and every possible spread that can be created from three different strikes. If the spread is highlighted in white that means the spread is listed on an exchange. For example, a simple straddle may be listed but the combo may not be listed yet. If the user clicks on the straddle that user will see the detail of the spread; the theoretical price and information for each leg, including all the Greeks.

Users can launch an order on the spread or individual legs by clicking on the bid or ask. Users can also lock the spread and tie it to a different underlying price to see the change in theoretical value. If the spread doesn’t exist on the exchange or there is no market for the spread, users can submit an RFQ (request for quote) on the spread and see the market data pop into the component as soon as a market maker responds to the RFQ.

If users want to monitor the spread, they can simply drag the spread into a Hot Watch where the system will continue to calculate the theoretical price and greeks as the underlying market or volatility changes.

Price Spreads by Theoretical Value

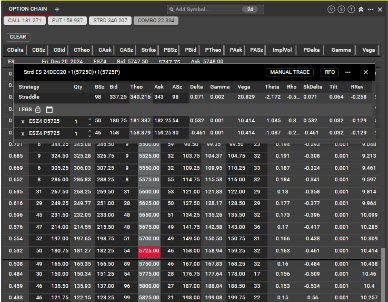

Many professional options traders like to build spreads from theoretical value. This is most useful when you know exactly the structure that you want to trade in and exactly the ratio you want.

For example, if a user wants to create a 65/68 put vertical, the user will left click on a 65 put theoretical value indicating a buy and launch the spread build functionality. The user then will right click on the 68 put indicating a sell. The user has identified a put vertical and if it exists on the exchange, will see a market on it. This can be manipulated further by adding another leg or increasing the size of one leg, turning it into a 1 by 2.

Clicking a specific theoretical value is a faster way if you know exactly what you want to do.

How the Portfolio Works

It is important to remember that inside your Portfolio component, where you can see your real-time P&L and risk, your spreads will show up as individual legs, not as a single trade. This is to avoid confusion if you add legs to your spread or have other traders in your portfolio. The best way to monitor the spread itself is to add it to hot watch.

The Rival One Options Platform feature has a great deal of capability in terms of monitoring the spread market. There is a lot of flexibility in how you want to configure your work space.

See how Rival One leverages advanced features to price and trade option spreads. Whether you’re a seasoned trader or just getting started, Rival One offers the tools you need to succeed in today’s fast-paced markets.

Watch our demo for more insightful information about the Rival One Options Platform features.